What are the Hidden Costs of Running an Amazon Business

TL;DR

Amazon fees like referral charges, FBA costs, and subscriptions add up faster than most sellers expect.

Hidden costs include storage penalties, return processing, prep/labeling fees, removals, and rising ad spend.

Promotions (coupons, deals) come with extra Amazon fees beyond the discounts you offer customers.

Operational costs such as freight, duties, insurance, software, and content creation often go overlooked.

Stockouts cost more than storage fees; they impact sales momentum, rankings, and ad performance.

Careful planning, cost tracking, and smart tools like SellerQI help sellers control expenses and protect profits.

Running an Amazon business can look simple from the outside, but many sellers quickly realize that profits are not as simple as sales minus costs. Most sellers are aware of referral fees, FBA charges, and subscription costs, but they often underestimate how quickly these add up.

On top of that, there are less obvious expenses like long-term storage penalties, return processing fees, unplanned prep charges, and rising ad spend that can silently shrink your margins. A smart Amazon ranking strategy isn’t only about keywords and ads; it’s also about protecting your profits so you can keep fueling sales momentum.

In this blog, we’ll dig into the hidden costs sellers often overlook and how to stay ahead of them.

Core Amazon fees every seller should know (but often underestimate)

Many new sellers overlook how much Amazon’s fees can cut into profits. They usually pay attention to the main costs but miss how smaller, variable charges add up over time. Fees like referral charges, FBA costs, and subscription plans are not really hidden, but they can be tricky to understand.

If you’re not careful, these extra costs can quickly eat away at your profits.

1. Referral fees by category

One of the highest costs of selling on Amazon is the referral fee, the commission Amazon takes on every sale. Most sellers assume it’s the same across all products, but that’s not the case. The percentage varies by category, usually around 15%, but it can be higher or lower depending on what you sell.

Category | Referral Fee % |

Amazon Device Accessories | 45% |

Automotive & Powersports | 12% |

Baby Products | 8% (≤ $10), 15% (> $10) |

Base Equipment Power Tools | 12% |

Beauty, Health & Personal Care | 8% (≤ $10), 15% (> $10) |

Business, Industrial & Scientific Supplies | 12% |

Clothing & Accessories | 5% (≤ $15), 10% ($15–20), 17% (> $20) |

Computers | 8% |

Consumer Electronics | 8% |

Electronics Accessories | 15% (≤ $100), 8% (> $100) |

Footwear | 15% |

Furniture | 15% (≤ $200), 10% (> $200) |

Grocery & Gourmet | 8% (≤ $15), 15% (> $15) |

Home & Kitchen | 15% |

Jewelry | 20% (≤ $250), 5% (> $250) |

Pet Products | 15% (22% vet diets) |

Sports & Outdoors | 15% |

Tools & Home Improvement | 15% |

Toys & Games | 15% |

Video Game Consoles | 8% |

Watches | 16% (≤ $1,500), 3% (> $1,500) |

2. Amazon FBA fees

One of the biggest costs sellers tend to underestimate is FBA fees. On the surface, it sounds simple: Amazon handles storage, picking, and packing for you. But the reality is, these fees vary depending on product size, weight, and even the time of year.

Standard storage may look affordable, but during peak seasons like Q4, rates jump. Oversized or heavy items also cost much more to store and ship. Add in long-term storage charges for slow-moving stock, and your margins can shrink quickly. Understanding these costs upfront helps you price smarter and avoid surprises that eat into your profits.

3. Subscription fees

The fixed $39.99 monthly subscription fee for the Professional selling plan is something every seller knows about, but many, especially new sellers, underestimate its real impact. On paper, it looks like a small, manageable cost. But during months when sales are low, that flat fee can start to feel heavy on your margins.

Here’s why it’s often underestimated: the break-even point. The Professional plan only makes sense if you’re selling more than 40 units per month. Sellers with low, seasonal, or inconsistent sales often overlook this math and end up paying more than they need to. Factoring in this cost upfront helps you avoid surprises and choose the right plan for your business stage.

True hidden costs that many Amazon sellers miss

1. Storage overage fees

One of the highest hidden costs on Amazon comes from storage overage fees. If your products sit in FBA warehouses too long, Amazon charges aged inventory penalties. As of 2025, units stored over 181 days are charged $1.50 per cubic foot, and items over 365 days can cost $6.90 per cubic foot or $0.15 per unit (whichever is greater).

These long-term storage fees can add up quickly, especially if you overstock or have slow-moving products. Another surprise comes during Q4 (October to December), when standard monthly storage fees rise.

Season | Item Size | Storage Fee (per cubic foot) |

Off-peak (Jan–Sep) | Standard-size | $0.78 |

Peak (Oct–Dec) | Standard-size | $2.40 |

2. Return processing fees

Another hidden cost many sellers underestimate is return processing fees. Whenever a customer sends back an item, Amazon charges you for handling it. It is equal to the original FBA fulfillment fee (ranges from about $2.12 to $6+ per unit, depending on size and weight).

Category | Return Rate Threshold |

Amazon Device Accessories | 11.3% |

Baby Products | 9.3% |

Beauty, Health & Personal Care | 5.5% |

Clothing, Backpacks & Luggage | 12.8% |

Consumer Electronics | 11.2% |

Electronics Accessories | 8.8% |

Home & Kitchen | 8.1% |

Jewelry | 10.8% |

Pet Products | 10.2% |

Sports & Outdoors | 8.7% |

Toys & Games | 4.7% |

Watches | 12.0% |

Disposal fee: Around $0.97 to $2.83 per unit, if the item is unsellable and you ask Amazon to dispose of it.

Refurbishment fee: Varies by product but can be charged if Amazon prepares the item for resale.

Even when an item is perfectly fine, you still pay a fee for the return. Over time, these small charges add up. Monitoring your return rates help reduce unnecessary returns and keep these hidden costs under control.

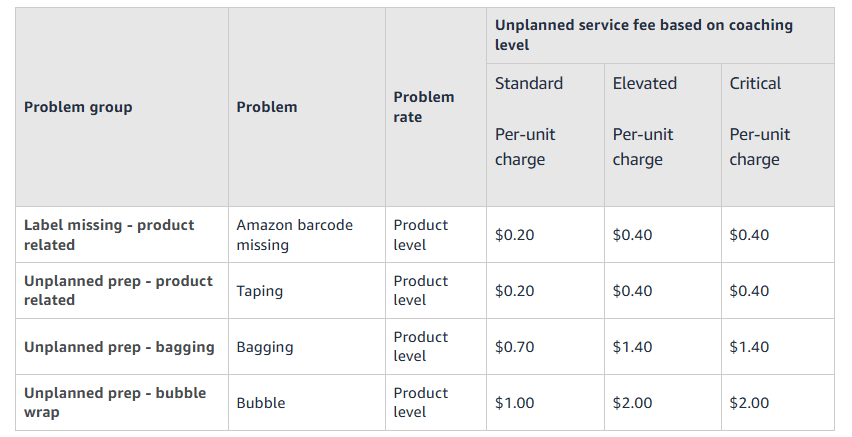

3. Unplanned prep and labeling fees

Another cost that often surprises sellers is unplanned prep and labeling fees. When you send inventory to FBA, Amazon has strict guidelines for how products should be prepared, things like poly-bagging, bubble wrapping, or applying scannable barcodes. If your shipment doesn’t follow these rules, Amazon will step in and fix it for you, but they won’t do it for free.

For example, if items arrive without proper labels, Amazon charges a per-unit labeling fee. The same goes for prep services like bagging or taping. These charges might look small at first, but they add up quickly across large shipments.

List of the Unplanned prep and labeling fees

4. Advertising fees

A common hidden cost sellers miss is how advertising spend slowly increases over time. Most people focus on ACoS (Advertising Cost of Sale), which is how much you spend on ads compared to the sales those ads bring. While this is important, it doesn’t give the full picture.

Reasons For Increasing Advertising Costs

The bigger metric to watch is TACoS (Total Advertising Cost of Sale). This measures ad spend against your total sales, not just ad-driven sales. If TACoS keeps climbing, it means ads are eating more into your overall revenue, even if your ACoS looks perfect.

For example, your ACoS might be 25% and seem fine, but if your TACoS has jumped from 8% to 15%, your profit margins are shrinking. This slow growth happens when you rely too heavily on ads without growing organic sales. Keeping TACoS under control ensures your ad spend is sustainable and your business stays profitable.

5. Coupon and deal fees

Coupons and deals may look like simple ways to boost traffic and sales, but the real cost is often higher than most sellers realize. It’s not just the discount you give to customers; you’re also paying Amazon’s fees on top of that, which can quickly cut into your profits.

For coupons, Amazon introduced a new two-part fee structure in June 2025. First, you pay a flat $5 upfront fee every time you create a coupon, whether it gets used or not. Then, if shoppers redeem the coupon, Amazon charges an additional 2.5% of the sales generated. And of course, you still have to cover the discount you offered to customers.

For deals, like Lightning Deals or Best Deals, the costs are even steeper. On regular days, you’ll pay a flat $70 per day plus 1% of related sales. During big shopping events like Prime Day, the fee jumps dramatically to $500 for Lightning Deals and $1,000 for Best Deals.

6. FBA inventory removal fees

Another hidden cost that sellers often overlook is FBA removals and disposals. When you have unsellable, stranded, or slow-moving inventory sitting in Amazon’s warehouses, you have to decide whether to remove it or let Amazon dispose of it, and neither option is free.

Removal fees are charged per unit when you ask Amazon to send inventory back to you. Disposal fees apply if you choose to have Amazon throw it away. While these charges may sound small, they add up quickly if you’re clearing out dozens or even hundreds of units.

Many sellers only think about storage fees, but removals and disposals can become a recurring cost if you overstock or list products that don’t sell as expected. The best way to avoid these fees is to plan inventory carefully, monitor sell-through rates, and adjust your ordering so you don’t end up paying to clear excess stock.

Operational costs that many Amazon sellers overlook

Beyond Amazon’s own fees, there are several operational costs that many sellers forget to factor in. These don’t show up in Seller Central, but can take a big bite out of your profits if ignored.

First, there are freight forwarding, customs duties, and import taxes essential for anyone sourcing products overseas. Then add insurance and liability coverage, which protects your business if products cause damage or injury.

Quality control inspections before shipping are another expense that ensures products meet standards and avoid costly returns later. On the marketing side, you’ll need to budget for product photography, videos, and listing content to stay competitive.

Many sellers also rely on software subscriptions for PPC management, inventory tracking, or repricing tools. Individually, these costs may seem small, but together they significantly affect your bottom line, and smart sellers plan for them.

Stockouts: The opportunity cost sellers ignore

Many sellers focus heavily on avoiding high storage fees, but the bigger threat is actually stockouts. Running out of inventory doesn’t just pause sales; it creates a ripple effect that can hurt your business long after your stock is back.

When you’re out of stock, you often lose the Buy Box, which means competitors can take your sales. This also breaks your sales momentum, making it harder to climb back to your previous ranking once you restock.

On top of that, any ad spend you put into campaigns becomes wasted if your listing is unavailable. Ads can’t convert without inventory, and the gap in sales hurts your organic ranking, too. The cost of being out of stock is far higher than paying a few extra dollars in storage fees. Smart inventory planning keeps your products live, your ads effective, and your rankings strong.

How to control hidden costs in your Amazon business

Track inventory regularly: Check Amazon’s Inventory Health Reports weekly. Set automatic alerts in Seller Central for aged inventory so you can act before long-term fees apply.

Plan stock smartly: Ship smaller batches more often instead of overstocking. Use demand forecasting tools to match inventory with sales trends.

Monitor returns: Analyze return reasons in reports. If customers complain about “wrong size,” adjust your size chart. If packaging causes damage, switch to sturdier materials.

Follow FBA prep rules: Print barcodes before shipping, use polybags for liquids, and bubble wrap fragile items. This avoids Amazon’s prep/labeling service fees.

Watch TACoS, not just ACoS: Track both metrics monthly. If TACoS rises, shift the budget from ads to content optimization to grow organic sales.

Budget for promotions: Test coupons on regular weeks instead of relying only on Prime Day deals. Calculate true costs before launching.

Account for operations: Compare freight forwarders, negotiate better insurance premiums, and use all-in-one tools to cut software expenses.

Prevent stockouts: Maintain safety stock, especially before Q4. Use restock alerts in Seller Central to reorder on time.

Ready to grow with confidence?

Hidden costs are a reality of selling on Amazon, and ignoring them can seriously cut into your profits. From referral fees and FBA charges to returns, ads, and storage spikes, every detail matters. But with careful planning and regular monitoring, you can stay in control.

That’s where the ultimate Amazon seller growth platform helps you win. With AI-powered insights, SellerQI helps you instantly analyze, optimize, and scale your Amazon business. From product research to PPC optimization, you get all the tools you need to grow smarter, cut hidden costs, and boost profits.

Start using SellerQI today and take your Amazon business to the next level!